Know Your Real Estate Options

Due to the cyclical nature of real estate there are many properties where the indebtedness on the Property exceeds the value of the Property. This puts property owners in a very difficult position when they want to sell the Property or need to get rid of the Property because they can no longer afford it.

There are many options that an owner has prior to, and even after foreclosure. These options include; Financial Workouts, Short Sales, Deeds In Lieu Of Foreclosure, Loan Modifications and Bankruptcy.

I. THE FORECLOSURE BY ADVERTISEMENT PROCESS

Stage 1- Mortgage Company Collection Efforts

On average a mortgage company will wait 90-days to turnover a defaulted mortgage to their local attorneys to commence foreclosure actions. During the initial 90-day period, the mortgage company will call, write, and otherwise contact property owners continuously to try to get them to make payment arrangements.

Stage 2- Collection Efforts by Attorneys for Mortgage Company

Approximately, on the 91st day from the last payment, the file on the defaulted mortgage is turned over to the mortgage company’s local attorneys. These attorneys will write letters of the impending foreclosure for approximately 30 days. Upon the expiration of this period, these attorneys will start noticing the Foreclosure Sale. This notice will be posted on the front door of the Property and/or will be sent by certified mail to the Property address.

Stage 3- Notice of Foreclosure

State law requires that this Notice of Foreclosure be advertised for four weeks prior to the foreclosure sale. On the sale date, the Property will be sold at auction at the County courthouse. At the auction, the Property is either sold to the highest bidder, or the mortgage company who foreclosed the Property, will make a credit bid for the Property.

If there is one mortgage, and the foreclosure sales price or the credit bid is equal to or in excess of the mortgage indebtedness, the property owner’s indebtedness to the first mortgage holder is cancelled.

If the foreclosure sales price or the credit bid is less than what is owed to the first mortgage holder, then there is a deficiency, which the property owner is liable for. Additionally, if the second mortgage holder does not receive proceeds from the sale to satisfy its debt, the property owner would be liable for that deficiency also.

Once the Property is sold, the Redemption Period begins.

Stage 4- Redemption Period

The Redemption Period gives the property owner a period of time to redeem, i.e., buy back or sell, the Property.

The property owner may redeem the Property by paying the mortgage holder the sum for which the Property was sold at foreclosure, plus taxes paid, and accrued daily interest at the same rate as the mortgage.

| Type of Property | Normal Period |

| Residential Property If amount claimed to be due on the mortgage at the date of the notice of foreclosure is more than 66-2/3% of the original indebtedness secured by the mortgage |

6-MONTHS |

| Residential Property[1] If amount claimed to be due on the mortgage at the date of the notice of foreclosure is less than 66-2/3% of the original indebtedness secured by the mortgage |

1-YEAR |

| Commercial Property/Industrial Property | 6-MONTHS |

***If the Property is deemed to be abandoned, the redemption period may be shortened***

The owner may use the Property rent free for the entire Redemption Period, whether they intend to redeem the Property or not. Accordingly, if a property owner knows that it is not going to be able to retain the Property for whatever the reason, knowledge of their rights under the law can be very beneficial in planning for their future.

Stage 5- Eviction Process

If the property owner does not redeem, and does not vacate the property, an Eviction Action must be commenced in the local district court to evict the property owner. To accomplish this, a complaint is filed with the district court and the property owner is served. A court date is usually held within 10 to 20 days. The property owners and any occupants are allowed 10 days from the date of the hearing (if a judgment is entered), to move from the premises. If the property owner does not vacate by the required date, the Court will issue an order authorizing a Court Officer to evict the property owners, any occupants, and their possessions. This process will take about 30 days.

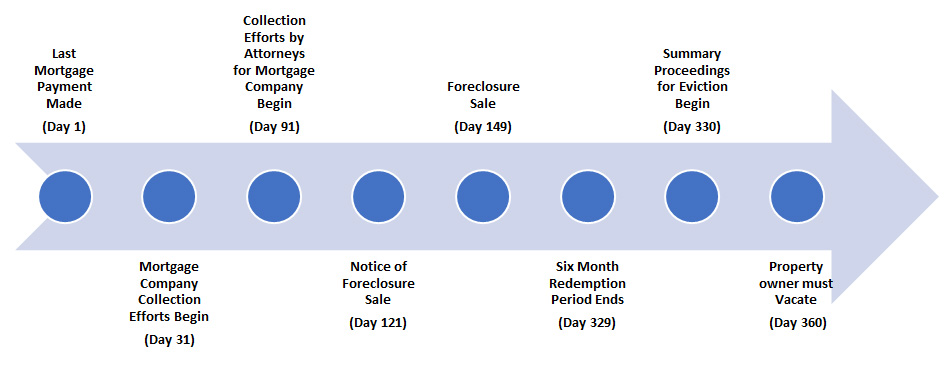

Foreclosure Process Timeline

As depicted below, with proper planning, a property owner can remain in their home for a period of approximately 12 to 18 months’ rent free[2], build a nest egg, and plan for the future. Additionally, if the property owner knows that a bankruptcy is inevitable, this process can be extended by at least 30 days, by filing a bankruptcy petition immediately before the Foreclosure Sale.

II. OPTIONS

A. Ride out the Foreclosure Process

As outlined above, a property owner can ride out the foreclosure process and stay in their house rent free for approximately one year, and with the money that will be saved, create a nest egg, to plan for the future. During the Redemption Period, the Property can only be redeemed for payment in full, therefore, during this period a property owner is free to lease the Property and retain the proceeds.

B. Short Sales

A “Short Sale” occurs when a mortgage company agrees to discount the principal balance due to an economic hardship on the part of the mortgagor. The property owner sells the mortgaged property for less than the outstanding balance of the loan, and turns over the proceeds of the sale to the lender in full satisfaction of the debt. If there is second mortgage on the Property, they will also have to approve the sale. In some cases, the property owner may be required to come out of pocket to satisfy the deficiency to the junior mortgage holder to obtain a release from the deficiency.

Short Sales can take place either before foreclosure or during the Redemption Period. Typically, lenders do not accept Short Sale offers or requests for short sales until the mortgage is in default.

CAUTION: A property owner who intends to stop making payments on its mortgage, should change the location of its bank account if they bank at the same financial institution that holds its mortgage, as the mortgage company will have a Right To Set Off, i.e., they will be able to seize the money in the bank account if the mortgage is in default.

If a successful Short Sale can be facilitated, all parties benefit. The property owner benefits as they are able to sell their Property, satisfy their indebtedness, and minimize the damage to their credit. The mortgage company benefits as they receive proceeds from the sale equal to or greater than what they would have received through foreclosure when costs, interest, and the time value of money are taken into account.

During a Short Sale negotiation, the property owner must convince the mortgage company that they are unable to afford the Property, satisfy any deficiency, and that the Short Sale is in the best interest of the mortgage company. The property owner, real estate agent, and attorney should work hand in hand towards the goal of successfully completing the Short Sale.

This process should start when the Property is listed with the real estate agent. At this point, the attorney should advise the real estate agent how the purchase offer should be drafted to ensure (1) that sufficient time is allocated for the negotiation with the mortgage companies, and (2) that the property owner is not bound to sell the Property if the Short Sale cannot be approved. The real estate agent should price the Property aggressively so that an offer can be submitted to the mortgage company. Even if the property owner believes the offer is too low, it should nonetheless be submitted to the mortgage company, so that a dialogue can be started between the parties. Even if the offer turns out to be too low, the parties can negotiate a mutually beneficial resolution to get the Property sold.

A mortgage company will normally require the following documents in making its determination of whether or not to accept the Short Sale:

- Purchase Agreement with protective language regarding short sale

- Listing Agreement

- Hardship letter- should be written by attorney after consultation with client

- Documentation evidencing hardship, i.e. divorce judgment, termination letter, unemployment, medical bills, etc.

- Information concerning monthly income and monthly expenses (Financial Statement)

- Information concerning all assets/liabilities (Financial Statement)

- Two most recent tax returns

- Two most recent paystubs

- Description of condition of property (point out problem areas)

- Loan Pre-Approval of Buyer

- Signed Attorney Authorization form

- Most Recent Invoices from Mortgage Companies

- Two months bank statements

- Preliminary HUD-1

***The preliminary HUD-1 should contain the following***

Line 504 should show the proceeds going to 1st Mortgage Holder

Line 505 should show the proceeds going to 2nd Mortgage Holder[3]

Line 603 should be $0.00

***The preliminary HUD-1 should not contain the following***

Home Warranty

Water Escrow

Other fees that may slow down short sale approval process

In a short sale, the Property is sold in AS IS WHERE IS condition, and therefore, the property owner should not spend any money to improve the Property prior to sale. Depending on the mortgage company, the Short Sale process should take between 45 and 60 days[4]. One of the final steps in the Short Sale approval process will be an appraisal that will be conducted by the mortgage company.

C. Deed in Lieu of Foreclosure

A “Deed in Lieu of foreclosure” is a transaction where the property owner conveys the Property

to the mortgage company to avoid a foreclosure sale. Due to the current financial condition of banks, and the large amount of property that they now own, these transactions are few and far between.

This transaction benefits a property owner as the mortgage company will agree to release the personal indebtedness associated with the defaulted loan in exchange for the transfer of the Property. Additionally, the property owner avoids the public notoriety of the foreclosure proceeding and minimizes the damage to their credit. This transaction benefits the mortgage company as it eliminates the time and costs involved in the foreclosure, redemption, and eviction process outlined above.

A Deed in Lieu of Foreclosure is not an option when there is a 2nd mortgage on the Property. In this situation the property owner could only transfer the Property to the 1st mortgage holder subject to the 2nd mortgage, which would put the 1st mortgage holder in a worse position than if they were to foreclose on the Property and eliminate the 2nd mortgage.

“Cash for Keys” is a program where the mortgage company pays the property owner to move out of their home after the foreclosure sale. This is done so that the move out is done in an orderly and clean manner without damage to the property, fixtures, and appliances, intentionally or otherwise.

D. Bankruptcy

If a property owner’s financial situation necessitates the filing of a bankruptcy petition, they should speak to a bankruptcy attorney prior to the Foreclosure Sale.

CAUTION: There are many more options available to a property owner prior to the Foreclosure Sale, than there are after the sale takes place. Accordingly, a bankruptcy attorney should be consulted prior to the Foreclosure Sale to preserve legal rights.

If the property owner has determined that they either cannot or do not want to save the Property, a Chapter 7 bankruptcy could provide the elimination of all indebtedness without an obligation to repay creditors. As outlined above, the filing of a Chapter 7 bankruptcy immediately prior to the Foreclosure Sale will extend the property owner’s time in the house for a minimum of 30 days.

If the property owner is behind on its mortgage payments, and it wants to keep the Property, it can repay the arrearages over a three to five-year period under a Chapter 13 bankruptcy plan. Additionally, if the junior mortgage is completely unsecured, a competent bankruptcy attorney can strip the junior lien, i.e. get rid of the junior mortgage, through an adversary proceeding [lawsuit] in the bankruptcy court during the pendency of a Chapter 13 case.

Additionally, under the Home Affordable Modification Program (“HAMP”), homeowners can now attempt modifications of their mortgage loan during the bankruptcy process.

E. Mortgage Fraud Litigation

One of the most powerful and least known options for a property owner are the remedies they have under Federal and State law to rescind a mortgage. Depending on the factual circumstances, a property owner may be able to rescind a mortgage and/or have valuable claims under the following theories of law:

- Truth in Lending Act (TILA)

- Credit Repair Organizations Act (CROA)

- Real Estate Settlement and Procedures Act (RESPA)

- Michigan Mortgage Brokers, Lenders and Servicers Licensing Act

- Common Law Fraud

- Breach of Contract

These claims all surround how the mortgage was sold, whether the Truth in Lending Disclosure was accurate, whether certain statutory procedures were followed, and whether the property owner received what they were sold. The most powerful claims are those brought under TILA within 3 years of a refinance.

F. Loan Modifications

Loan modifications that seek to fix interest rates, lower interest rates, place mortgage payment arrearages at the end of the loan, and lower monthly payments are all feasible modifications. Lowering the principal balance on a loan is an extremely difficult modification. Persons seeking a loan modification should be very careful of fly-by-night entities offering loan modifications. Although some are legitimate, many of these companies make huge promises and fail to deliver. Homeowners have many free alternatives available to them through municipalities and religious organizations, who often do a better job at little or no cost to the homeowner.

Additionally, the Michigan Credit Services Protection Act, MCL 445.1821, et seq., prohibits people from charging or receiving money prior to completing services for (1) improvement of credit history, (2) obtainment or extension of credit, and (3) advice or assistance regarding foreclosure of a real estate mortgage. This would bar non-attorneys from receiving money in advance for a promised loan modification.

III. CONCLUSION

Knowledge of the foreclosure process and the law allows a property owner to maximize certain benefits in an otherwise bleak situation.

[1] In certain counties, if the property exceeds 3 acres in size, regardless of the amount of indebtedness due, the redemption period may be for the full one-year period.

[2] Depending on the length of the Redemption Period.

[3] The first mortgage holder will generally allow for approximately $3,000.00 to be paid to the second lien holder.

[4] This is generally the time it takes to obtain bank approval; however, some companies/investors are extremely slow in administration and determination of whether to accept the offer.